Instructions

Wherever you see 202X please use the year 2022.

David Strathford operates under a sole trader structure T/As Cutting Edge business is an Accrual BAS, is registered for GST and PAYG Withholding. The business has been operating since 1/1/202X.

(Note: All documents, names and numbers in the assessment are fictional. Take that all ABN numbers have been checked on the ABR website)

General Information

- Cutting Edge is a franchise and has monthly fees to the Paradise Gardens Group.

- David Strathford bought a shop on the 1/3/202X and receives rent monthly through Kents Real Estate.

- GTL Insurance – Trauma Insurance to cover David for loss of earnings. The insurance also covers for the employment of staff to run the business while David is ill. The accountant instructs that the insurance is a business expense.

- Car Expenses – The accountant instructs David to start a logbook as of 1st April 202X. To enter all the places and kilometres travelled and then he/she will adjust at the end of the year. Post other car expenses as well.

- Electricity – The electricity for the business is 20% of the total on the bill. This relates to the room where the office is located in relation to the size of the rest of the house.

- Secure Self Storage – This is to store business stock and equipment.

- Mobile Phones – Mobile Phones for David and Kerrie are a 100% business expense.

- Home Phone – Home phones, internet and white pages are 20% business expense.

- The BAS for the quarter 1/1/202X to 31/3/202X was a refund of $8844 (Collected GST – $1668, Paid GST – $12957, PAYG Withholding – $2445)

- Create a suspense account and place all queries to the accountant or the business owner into the suspense account. When you receive the answers allocate them to the correct GL account.

Other Details

Kerrie and David Strathford have a daughter named Tania who works at the local dress shop.

Accounts – See Instructions Buttons

- Using the MYOB file supplied set up the following tax codes – ABN, ANR, FRE, GST, ITP, ITS, N-T. Delete all unnecessary codes.

- Set up the chart of accounts using the table of chart of accounts provided.

- Enter the Opening Account Balances as at the Financials at April 202X via a General Journal. Use General Journal as opening balance is part way through the year.

- Enter the Outstanding Debtors and Creditors invoices at April 202X using the Detailed reports in the pack.

- Setup Bank Reconciliation

Customers – See Customer Documents Buttons

- Post Sales Invoices using Item Layout.

- Post Customer Deposits as orders posting with the date the cheque was received into the bank then converting to invoices as required.

- Enter all customer receipts using undeposited funds and making sure paid into bank at correct date. Take payments off oldest invoice first.

- A Gift Discount Voucher was issued for a client, Susan Kilby on the Monday of the last week in May after David heard of her husband being in hospital. This was to be applied as a credit to her account.

- Customer Complaint – Finalise the account in favour of J.Lawton

Suppliers – See Supplier Documents Buttons

- Post Orders

- Post Bills

- Assigned ABN numbers, Terms of Trade to supplier’s cards and Account Default Code

- Payments are to be processed through the Electronic Clearing Account and a Bank File created for each payment. Use ID BankDate.aba as syntax if there are Bank Details supplied. (Note: You will need to establish the Bank Account to accept Bank Files. Use for Bank Code: BBG and ID 1234)

- Supplier Query – Supplier sent a credit note to adjust price.

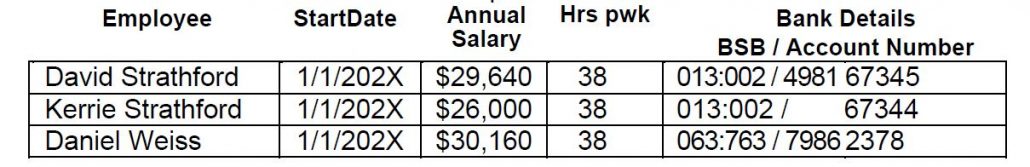

Payroll – See Employment Documents Buttons

- See 2020 tax tables attached – use these tax details if different from software and adjust figures manually if needed. No Leave loading and use Tax Declaration form and superannuation form for details.

- Run Payruns for the first 4 paydays in May, so first pay day 1st May. Pay week Sunday to Saturday with pay date the Saturday on that same week.

Notes:- David Strathford uses Online Banking to pay employees and inputs net wage into Online Banking system

- Use the Payroll Clearing Account as the Payrun Bank and then transfer to Bank.

- David Strathford took 2 days holidays in the first full week of May, so will appear on second payrun.

- Kerrie Strathford took 3 days Personal Leave in the second full week of May, so will appear on third payrun.

- Print detailed Superannuation Accrual Report for May for Superfund

Petty Cash – See Petty Cash Buttons

- Setup a Petty Cash Impress System using the excel spreadsheet provided and transferring into your accounting system at each reimbursement point. (Check Bank statements for Petty Cash Reimbursement Amounts)

- Post Cash Purchases but only Business Purchases

- The Float is $650 and the petty cash cheque is to be cashed as per the Cheque Book.

Adjustments/Notes

- A purchase entry in April for $55 was for a parking fine and not petrol. This cannot go through the business and must be adjusted.

- A sale for David Ormond for $55 in April was duplicated. Make adjustment for this sale (crediting Regular Mowing income) and date 1/5/202X. This can be credited off Invoice dated 23/04/202X.

- Ensure that the Private % has been accounted for – See Accountants Instructions at the beginning.

- Account for the BAS refund.

Reconciliations

- Reconcile the bank statements, loan statement and credit cards.

- Reconcile the petty cash.

Reports

- Print to PDF Receivable Reconciliation Report

- Print to PDF Payables Reconciliation Report

- Print to PDF Balance Sheet as at 31st May 202X

- Print to PDF Profit and Loss for the month of May 202X

- Print to PDF Cash Flow Report for the 3rd Week of May 202X (15th – 21st May)

- Print to PDF Profit and Loss for the 3rd Week of May 202X (15th – 21st May)